Docyt

Your tireless AI bookkeeper – automates 95%+ of accounting tasks, offers powerful analytics, and ensures bank-level security.

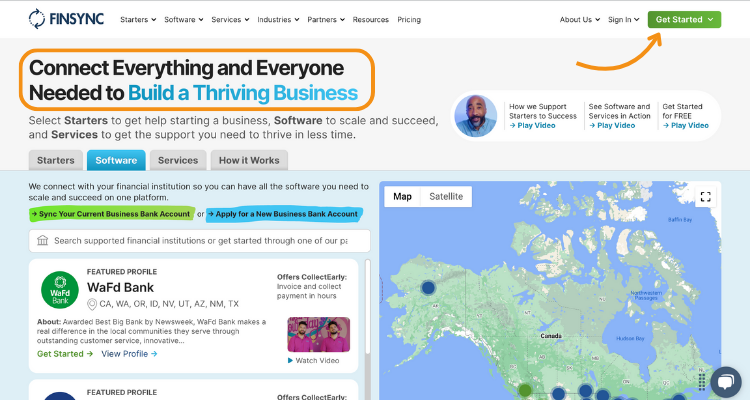

FINSYNC

Streamline your finances with this affordable, user-friendly, all-in-one accounting solution for freelancers and small businesses.

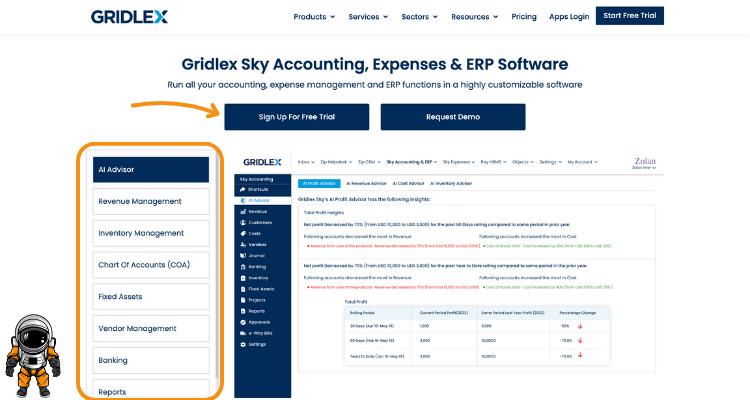

Gridlex Sky

Maximize efficiency and gain deep insights with this highly customizable accounting powerhouse, perfect for businesses needing tailored workflows.

Are you sick of endless spreadsheets and tax-time panic?

AI accounting software is your answer. Imagine automatic tracking, streamlined invoicing, and insights for smarter financial decisions.

Get ready to transform your bookkeeping with the best AI-powered tools.

Traditional accounting can feel like a never-ending nightmare. But fear not; AI is here to save the day!

AI accounting software takes the tedious work off your plate. Let’s explore the top 7 options and find the perfect fit for your business.

What is the Best AI Accounting Software?

AI accounting software is revolutionizing how businesses handle finances.

Forget manual data entry and mind-numbing calculations – these tools automate tasks, offer insights, and help you stay ahead of the curve.

But with so many options, which one is right for you? Here’s our curated list of the top 7 contenders:

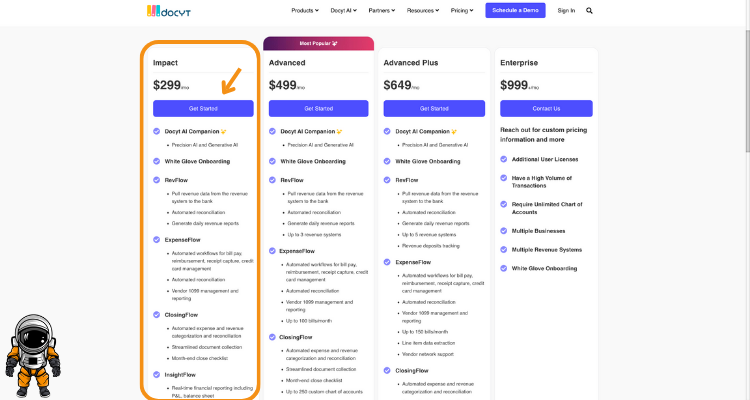

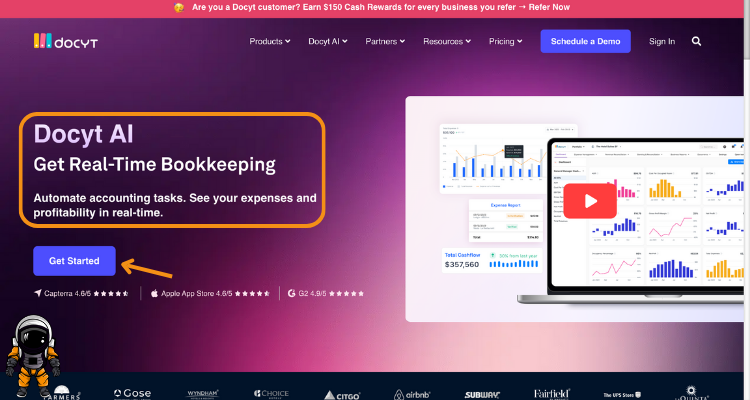

1. Docyt

Think of Docyt as your tireless virtual bookkeeper. It shines in automation, streamlining your accounting processes with incredible precision.

Imagine a smoother month-end close, effortless revenue reconciliation, and real-time financial insights at your fingertips.

Our Take

Docyt is a top-tier solution for businesses that want to maximize efficiency and gain deeper insights into their finances.

Key Benefits

- Automation & Efficiency: Docyt's AI automates 95%+ of tedious accounting tasks.

- Analytics & Reporting: Powerful dashboards reveal insightful patterns in your finances.

- Cloud-Based Access: Securely work from anywhere, anytime.

- Scalability: Designed to grow with your business.

- Security: Bank-level encryption and rigorous compliance keep your data protected.

- Mobile App: Track and approve expenses or payments on the go.

Pricing

- Starting price: $499/month

- Upgrades: Customizable packages available with more comprehensive features

Pros

Cons

2. Truewind

Truewind is like having a dedicated accounting team minus the hefty price tag. It combines cutting-edge AI with expert human Support, giving you the best of both worlds.

Our Take

Truewind is a fantastic choice if you crave extra expert Support alongside robust AI-assisted accounting.

Key Benefits

- Automation & Efficiency: Truewind handles the grunt work so you can focus on the bigger picture.

- Analytics & Reporting: Access detailed financial reports for informed decision-making.

- Cloud-Based Access: Work from anywhere with seamless online accessibility.

- Scalability: Truewind adapts as your business scales.

- Security: Top-notch data security practices to protect your information.

- Human Support: A dedicated team of CPAs offers valuable guidance.

Pricing

- Custom Pricing: Contact Truewind directly for a personalized quote tailored to your business.

Pros

Cons

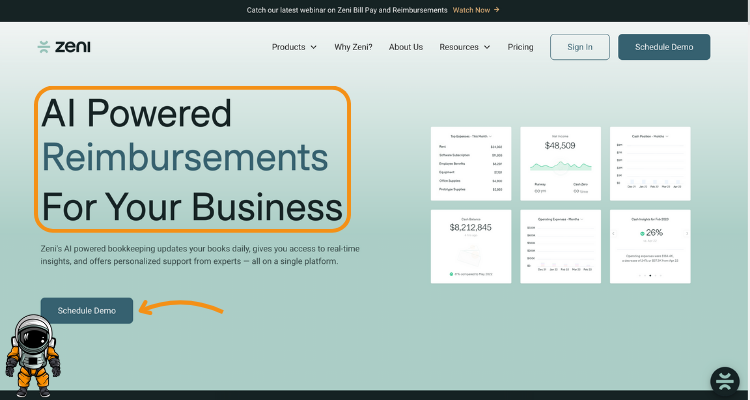

3. Zeni.ai

Zeni.ai is the perfect pick for startups and growing businesses that need streamlined back-office operations. It's designed to simplify your financial life so you can focus on growth.

Our Take

Zeni.ai delivers an excellent combination of automation and dedicated Support, perfect for scaling businesses that want to modernize their financial operations.

Key Benefits

- Automation & Efficiency: Zeni automates daily bookkeeping and financial tasks flawlessly.

- Analytics & Reporting: Gain real-time insights into your cash flow and key metrics.

- Cloud-Based Access: Collaborate with your team from anywhere, anytime.

- Scalability: Zeni's solutions grow with your business seamlessly.

- Security: Bank-grade security ensures your data is always protected.

- Dedicated Support: A team of finance experts provides top-notch Support.

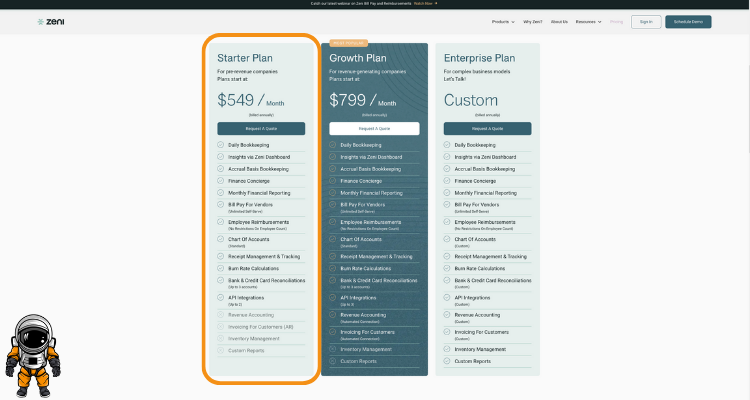

Pricing

- Startup Plan: $299/month

- Growth Plan: $599/month

- Custom Plans: Available for more complex needs

Pros

Cons

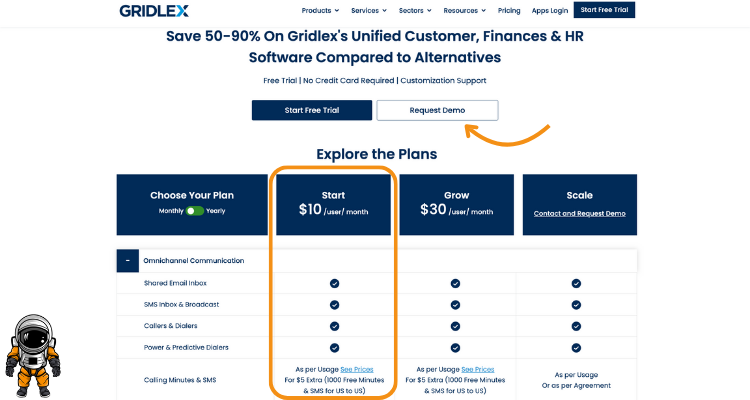

4. Gridlex Sky

Gridlex Sky is your versatile accounting powerhouse, particularly for businesses that crave customization. This could be the one for you if you have specific workflow needs or want flexibility.

Our Take

Gridlex Sky is a powerful solution for businesses that value adaptability and want to tailor their accounting processes precisely. Share

Key Benefits

- Automation & Efficiency: Streamline your processes and save precious time.

- Analytics & Reporting: Customizable reports help you track the most critical metrics.

- Cloud-Based Access: Secure access to your financials from anywhere.

- Scalability: Grows with your business, offering adaptable solutions.

- Security: Prioritizes robust data protection measures.

- Customizable Workflows: Design accounting processes to fit your unique organization.

- Integrations: Connect seamlessly with your existing business tools.

Pricing

- Contact Gridlex directly for customized pricing based on your needs.

Pros

Cons

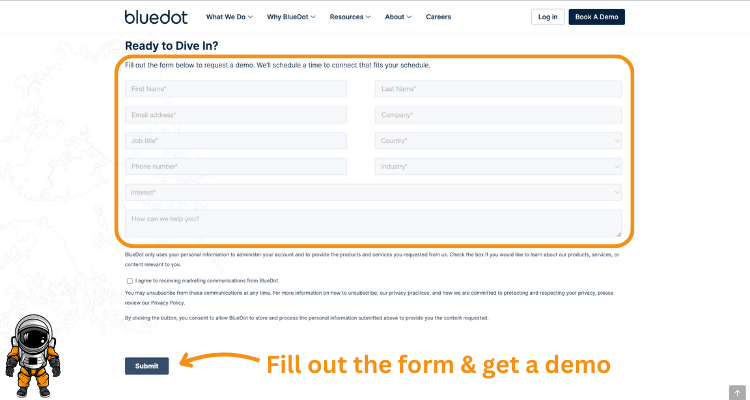

5. Blue Dot

Blue Dot specializes in simplifying the complex world of tax compliance, especially for global businesses. This could be your lifesaver if you must navigate international regulations or handle many employee expenses.

Our Take

Blue Dot is a valuable option for businesses with complex tax needs, especially those operating in a global environment.

Key Benefits

- Tax Expertise: Focuses on minimizing your tax burden and staying compliant.

- Automation & Efficiency: Streamlines tax-related processes, saving you time and headaches.

- Analytics & Reporting: Provides insightful reports on tax implications and savings opportunities.

- Cloud-Based Access: Work securely from anywhere.

- Scalability: Ideal for scaling businesses and those dealing with international expansion.

- Security: Prioritizes data protection with stringent security practices.

Pricing

- Contact Blue Dot for a personalized quote based on your specific needs.

Pros

Cons

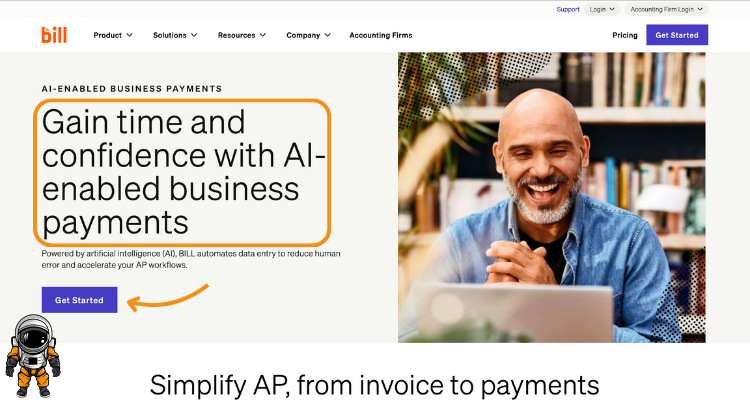

6. BILL

BILL is a well-rounded solution for simplifying unpaid and receivable accounts for businesses of all sizes. It optimizes cash flow and streamlines financial interactions with vendors and clients.

Our Take

BILL is a solid choice for businesses seeking to improve efficiency across their accounts payable and receivable processes.

Key Benefits

- Accounts Payable & Receivable (AP/AR) Focus: Streamlines bill payments and invoice collections effortlessly.

- Automation & Efficiency: Speeds up payment and invoicing processes significantly.

- Cash Flow Management: Gain better visibility and control over your cash flow

- Cloud-Based Access: Securely manage your financials from anywhere.

- Scalability: Flexible plans cater to businesses of different sizes.

- Security: Bank-level encryption safeguards your sensitive data.

- Integrations: Works seamlessly with popular accounting software.

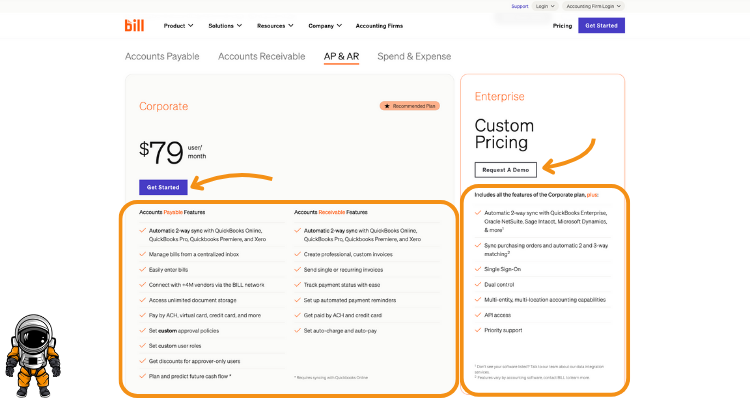

Pricing

- Essentials Plan: $39/user/month

- Team Plan: $69/user/month

- Corporate Plan: $89/user/month

- Enterprise Plan: Custom pricing is available

Pros

Cons

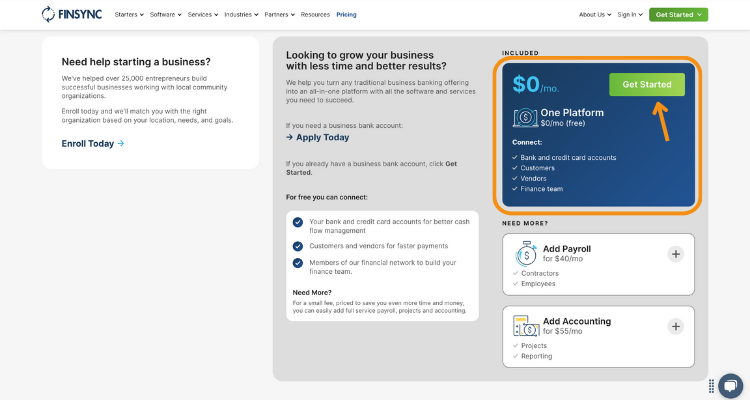

7. FINSYNC

FINSYNC is your go-to solution if you're a freelancer or small business owner who wants a no-fuss approach to accounting. It's designed to be super user-friendly while packing powerful features under the hood.

Our Take

FINSYNC is a fantastic choice for businesses that prioritize simplicity and want a comprehensive accounting solution at a great price point.

Key Benefits

- User-friendliness: Intuitive interface and minimal learning curve.

- Automation & Efficiency: Streamlines your accounting tasks for big time savings.

- All-in-one solution: Covers expense tracking, invoicing, reporting, and more.

- Cloud-Based Access: Securely work from anywhere, anytime.

- Scalability: Grows with your business, offering adaptable plans.

- Security: Prioritizes robust data protection measures.

- Integrations: Connects seamlessly with popular payment platforms.

Pricing

- Starting price: $49/month (with optional add-ons)

- Upgrades: Flexible pricing based on features and add-ons.

Pros

Cons

What to Look For?

When diving into AI in accounting, knowing what features and capabilities will benefit your organization is essential. As AI technology evolves, so does its application in automating and enhancing accounting tasks. Here's a streamlined guide to the critical aspects to consider:

- Integration with Existing Systems: Ensure the AI software seamlessly combines with your current accounting system and other financial tools. This synergy is crucial for smooth data management and minimizing disruption in economic processes.

- Machine Learning Algorithms: Opt for AI tools that utilize advanced machine learning algorithms. These are pivotal in analyzing financial data, predicting future trends, and providing insights into the company's financial performance and business growth opportunities.

- Data Analysis and Reporting: High-quality AI accounting tools should offer robust data analysis and financial reporting capabilities. They analyze historical data, automate repetitive tasks, and generate accurate financial statements and expense reports, aiding in strategic financial planning.

- Natural Language Processing (NLP): NLP allows finance and accounting professionals to interact with AI systems using everyday language. This feature simplifies querying financial data, generating reports, and extracting relevant data without deep technical expertise.

- Customization and Scalability: The chosen AI software should be adaptable to your specific business processes and scalable to grow with your business. This ensures it can handle increasing data volumes and complexity as your business evolves.

- Security and Compliance: With financial data at stake, security cannot be overstated. Ensure the AI tool complies with industry standards and regulations to protect sensitive information and reduce the risk of fraud.

- Expense Management: Look for AI tools that streamline expense management software processes, from automating entry to categorizing expenses. This not only saves time but also reduces human error.

- Predictive Analytics and Cash Flow Forecasting: Advanced AI tools should offer predictive analytics for forecasting future cash flow and financial health. This authorized businesses to make informed decisions and manage risks more effectively.

- Automation of Repetitive Tasks: Choose AI software that automates routine bookkeeping tasks, client communication, and other repetitive accounting tasks. This allows accounting professionals to pay more attention to strategic activities.

- User-Friendly Interface: A user-friendly interface ensures finance and accounting professionals can maximize the software's benefits without extensive training, making it easier to adopt and integrate into daily operations.

- Support and Training: Adequate Support and training are essential for smooth implementation and ongoing use. Look for vendors that offer extensive training materials and responsive customer support.

- Robotic Process Automation (RPA): RPA in AI tools automates repetitive tasks and workflows within financial processes, enhancing efficiency and accuracy in tasks like data entry and invoice processing.

- Fraud Detection: AI systems equipped with pattern recognition can identify anomalies in financial data, helping in early fraud detection and enhancing risk management.

- Client Communication: Some AI tools include features that facilitate client communication and provide timely updates and reports, which is crucial for maintaining trust and transparency.

In summary, selecting the right AI accounting software involves considering a mix of technological capabilities, security features, and user support.

By focusing on these critical aspects, accounting firms and finance departments can leverage AI to enhance financial data analysis, automate internal processes, and contribute significantly to business growth.

How Can AI Boost Your Bookkeeping?

In the evolving landscape of the accounting industry, artificial intelligence (AI) stands out as a transformative force.

AI's capability to analyze financial data and automate routine tasks is revolutionizing internal accounting processes.

By deploying accounting AI, businesses can manage their finances more efficiently, saving time for financial professionals to focus on strategic decisions.

This technology offers a new level of accounting automation, providing valuable insights into a business's economic health and identifying patterns in analyzing historical data that might go unnoticed.

AI doesn't aim to replace accountants but to raise their capabilities, allowing them to deliver more value to business leaders.

With AI, the accounting world is witnessing a shift towards more predictive and advisory roles, leveraging vast amounts of data to forecast business models and improve decision-making.

This shift enhances the efficiency of financial operations and drives business growth by offering a deeper understanding of economic performance and opportunities.

Buyers Guide: How We Conducted Our Research

When diving into AI accounting software, we aimed to provide a comprehensive and unbiased review. Here's how we approached our research:

- Pricing: We started by examining the cost of each AI accounting software product. Understanding the range of pricing models helped us gauge affordability and value for money across different solutions.

- Features: Identifying the best features of each product was crucial. We looked for unique capabilities that set each software apart, such as automation of routine tasks, data analysis precision, and user-friendly interfaces.

- Negatives: No product is perfect. We made a point to uncover what was missing from each AI accounting software. This included any limitations in functionality, usability challenges, or gaps in service offerings.

- Support or Refund: The availability of Support, community resources, or a clear refund policy played a significant role in our evaluation. We assessed whether companies offer robust customer support, accessible training materials, and fair refund policies to their users.

This systematic approach allowed us to provide a balanced perspective, highlighting the strengths and weaknesses of each AI accounting software product, thereby assisting potential buyers in making informed decisions.

Wrapping Up

In conclusion, integrating AI into the accounting realm doesn't signify the end for accountants but rather a pivotal evolution in how businesses manage and analyze data.

AI's unmatched ability to identify patterns and automate data analysis saves time and elevates financial professionals' strategic roles.

By embracing AI, businesses can harness technology's power to streamline operations, enhance accuracy, and drive decision-making.

As we've explored AI's transformative impact in accounting, it's clear that leveraging these advancements is critical to staying competitive and efficient.

Trusting in our insights comes from a deep dive into AI's potential and practical applications, ensuring our recommendations are geared toward empowering your financial strategies and operations.

Frequently Asked Questions

What are the key advantages of using AI accounting software?

AI accounting software offers automation, error reduction, real-time insights, enhanced cash flow management, and improved scalability. Save time and eliminate tedious manual processes.

How do I choose the best AI accounting software for my business?

Consider your needs: business size, industry, desired features (AP/AR focus, tax expertise, etc.), integrations with your existing systems, and budget.

Is AI accounting software secure?

Reputable providers prioritize data security. Look for solutions with bank-level encryption, robust compliance protocols, and certifications demonstrating their commitment to protecting your data.

Can AI accounting software replace my accountant?

AI augments your accountant's work, handling routine tasks so they focus on strategic analysis. It's a collaboration, not a replacement.

How much does AI accounting software cost?

Costs vary. Some solutions have tiered pricing based on features, while others offer custom quotes. Factor this into your decision.